A Stocks and Shares ISA allows you to invest up to £20,000 per tax year (2025–2026) in funds like Fundsmith Equity Fund or Fundsmith Stewardship Fund. Any gains or income you earn from these investments in the ISA are free from UK tax. You can start investing with a lump sum from £1,000 or a monthly direct debit from £100.

The Fundsmith Equity and Stewardship Funds aim to deliver long-term capital growth by investing in high-quality businesses that generate a sustainable return on capital.

Please note the value of investments and any income from them may fall and you may get back less than you invested. To learn more about the funds, please read the KIID and visit the factsheet pages.

A Fundsmith ISA allows UK residents to invest in Fundsmith’s funds tax-free.

Why should you invest in an ISA

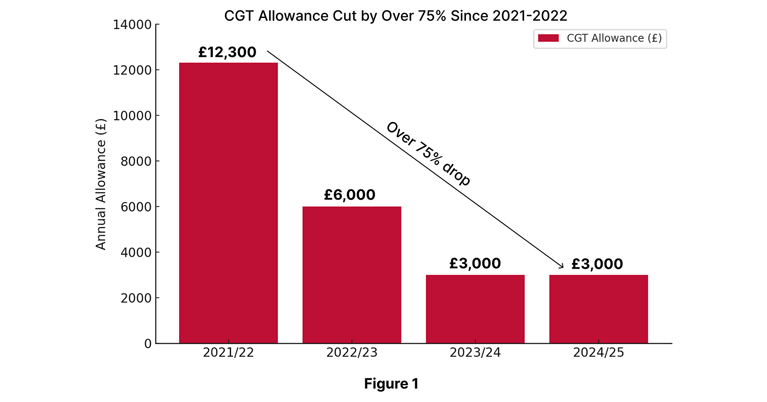

- The increasing tax burden for UK residents is a topic of intense discussion in the media. With UK tax allowances tightening, protecting your investment gains is important. ISA accounts remain one of the few ways of shielding your hard-earned money. With CGT allowances cut by more than 75% in four years, see Figure 1, ISAs offer a powerful way to grow your savings without paying tax on gains.

- With a much smaller CGT allowance, even modest profits on your non-ISA investments could be taxed when you sell them. And this can make a big difference to the final value of your investment.

- Although investments in the Fundsmith funds should be considered a long-term investment, for at least 5 years, you can withdraw your money at any time, free of charge to help pay for things like a house deposit, school fees, or to help fund your retirement.

Example

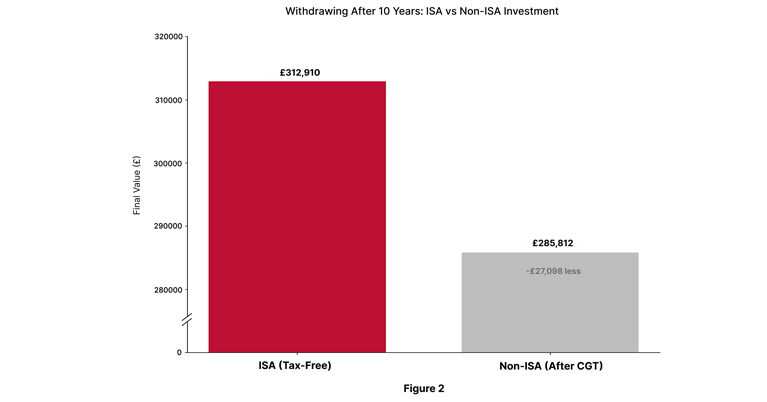

- Let’s say you invested your full ISA allowance of £20,000 per year for the past 10 years, before withdrawing the funds this year to buy a new flat. This example compares £200,000 invested in a tax-free ISA vs. a taxable non-ISA account over 10 years, assuming 8% annual growth.

- Please note: Figure 2 is a hypothetical example intended to illustrate the principle of compounding. It does not represent the current performance of Fundsmith or any other investment.

- While both accounts grow the same way, the ISA allows you to keep the full £312,910 tax-free. In contrast, the non-ISA account is reduced to £285,812 after paying Capital Gains Tax at 24%, resulting in £27,098 less. This would be more than enough to cover typical legal fees, stamp duty, or moving costs on an average UK house.

Benefits of investing via an ISA:

- Enjoy tax-free growth, with no Income Tax or Capital Gains Tax.

- Withdraw funds without paying tax, you can access your money at any time, though once withdrawn, funds can’t be replaced and additions will be considered further contributions to your annual ISA allowance.

- Make the most of your annual allowance, ensuring more of your money stays invested and working for you in a tax-efficient way.

Annual ISA limit

A Stocks and Shares ISA allows you to invest up to £20,000 per tax year (2025–2026) in funds like Fundsmith Equity Fund or Fundsmith Stewardship Fund.

Other ways to invest

Fundsmith offers a non-ISA account with no limit on how much you can invest and a Junior ISA for UK resident children under 18, with an annual allowance of £9,000 per tax year.

Tax-free returns

Enjoy tax-free growth with no tax on interest or capital gains within your Fundsmith ISA.

Transfers

You can transfer existing ISAs to or from other providers.

Use multiple ISA providers

You can have more than one ISA, even if you have invested elsewhere this year, you can still use your unused allowance with Fundsmith.

Risks

The value of your investment may fall, and you may get back less than you invested. Tax benefits are subject to change and their value to you will depend on your circumstances. No investment is suitable in all cases. If you are unsure of an investment, please speak to a financial advisor.

Our fees explained

- The fund has to pay expenses such as the investment management fee and administration fees. These costs are reflected in the Ongoing Charges Figure (OCF). For example, the T Class currently has an OCF of 1.04% per annum (per 30 June 2025 semi-annual report).

- There are no performance fees, upfront fees, or fees for debt or derivatives.

- The ISA account does not have any further fees.

Note

- If you elect to invest monthly, direct debits are taken on the 1st day of each month and must be set up 10 working days before.

- Our funds should be considered a long-term investment, with a minimum recommended holding period of at least five years.

- For more information about Fundsmith's investment philosophy, please read the Owner's Manual that can be found at www.fundsmith.co.uk and the prospectus.

FAQ

Q: What is the annual allowance limit?

A: Stocks and Shares ISA allows you to invest up to £20,000 per tax year (2025–2026) in funds like Fundsmith Equity or Fundsmith Stewardship. Start with a lump sum from £1,000 or a monthly direct debit from £100. Any gains or income you earn from you ISA are free from UK tax.

The value of the tax benefits to you depend on your personal circumstances and are subject to change. The value of your investment may fall and you may get back less than you invested.

Q: Can I invest in a Fundsmith ISA despite already having an ISA elsewhere?

A: You can have more than one ISA, so even if you have invested elsewhere this year, you can still use your unused allowance with Fundsmith. Or you can transfer existing ISAs from other providers.

Q: At what age is it best to open an ISA?

A: Starting early maximises your tax-free growth and the power of compound returns over time. The value of the tax benefits to you depend on your personal circumstances and are subject to change. The value of your investment may fall and you may get back less than you invested. If you are unsure about the suitability of an ISA for you, please seek financial advice.

Understanding APS ISAs

If a person with an ISA passes away, their spouse or civil partner receives an additional allowance equal to the value of the deceased’s ISA, called APS (Additional Permitted Subscription). To learn more about APS ISA, please visit our APS ISA page.